Shares of Citigroup (C) fell nearly 4% on Tuesday as investors digested its second-quarter results. Interestingly, this poor share price performance came even though earnings of $0.50 beat $0.10 on revenue of $19.77 billion, ahead of $700 million. dollars. Shares could potentially rally 40% just to get back to the company’s tangible book value of $71.15 per share. Such a benefit will certainly excite investors. However, to determine if stocks can reach that level, we must first determine if this tangible book value is sustainable and if the company can generate a sufficient return on equity to merit a valuation of 1x book value. On these questions, I believe the answers are yes and no.

Is Citi’s book value sustainable?

Given its worst performance among major banks during the 2008-2009 financial crisis and its long recovery since, Citigroup has always traded at a slight discount to its peers. It’s admittedly a bit intangible, but there’s this pervasive fear that if there’s a problem, Citi is bound to be exposed to it. Given that more than a decade has passed and the management that oversaw the problems of the financial crisis has been gone for years, it is not clear to me that this discount is justified. Still, investors should recognize that Citi’s results will come under greater scrutiny and that this discount won’t disappear tomorrow.

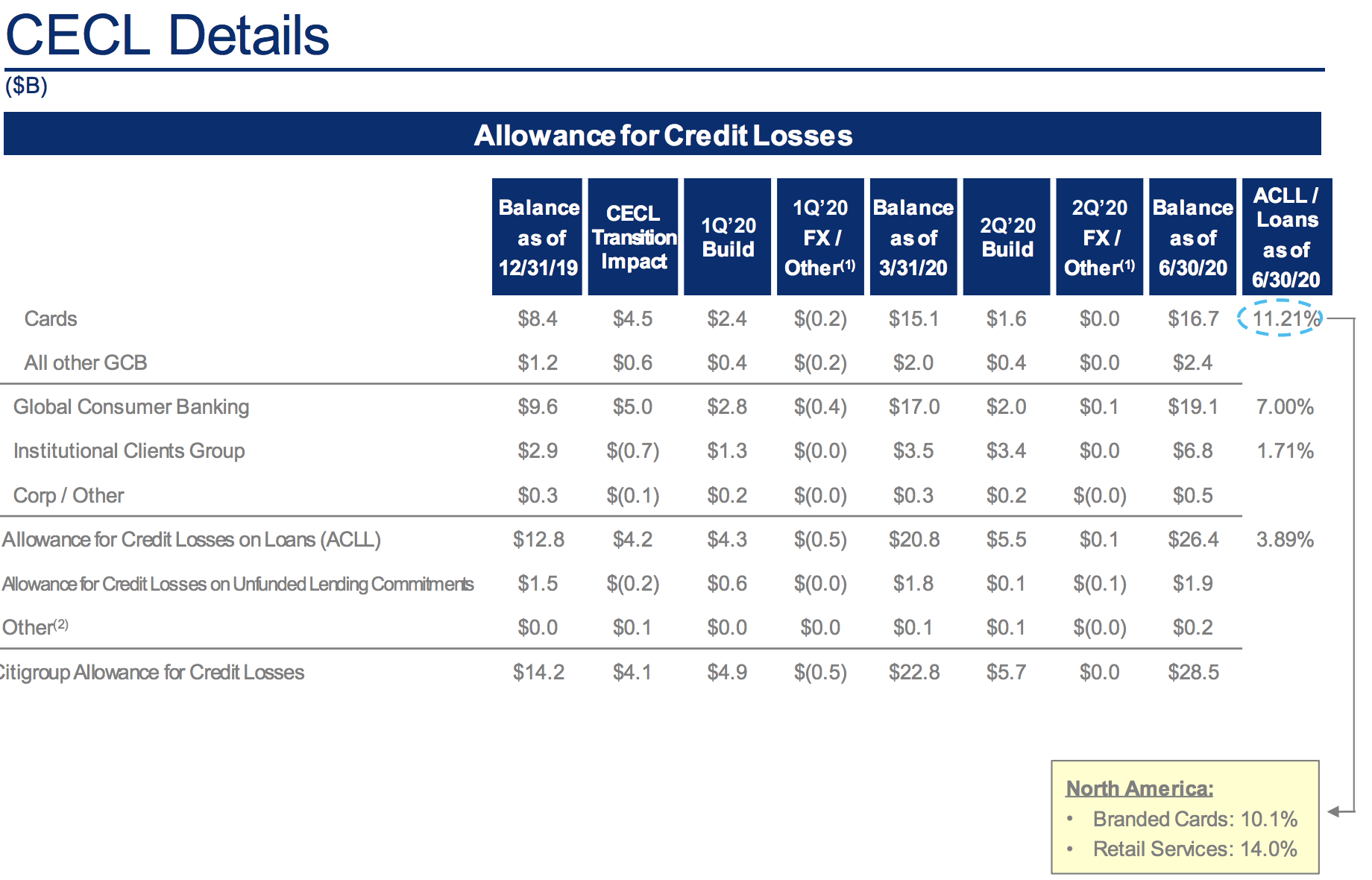

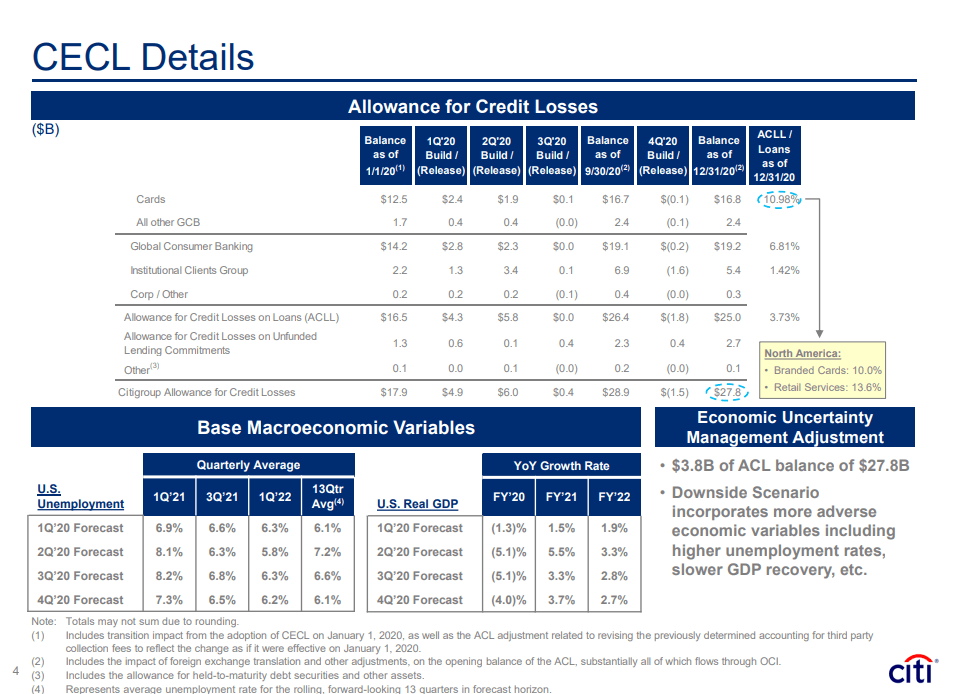

For this reason, I was pleased to see the company’s fairly aggressive reservations. During the quarter, the company set aside $5.6 billion to manage future loan losses. Loan reserves are sized to match what management expects total losses to be on existing business volume if their economic basis were to occur. This level of loss is based on the expectation that unemployment will be just below 10% at the end of the year, which is similar to the forecasts of the Federal Reserve. Now, that prediction could turn out to be wrong; no one knows the future, but Citi seems to be planning sensibly.

Indeed, if we look at how they break down their loan reserves, Citi’s $26.4 billion reserve against existing loans represents 3.89% of its loan portfolio. Now, no two banks’ loan portfolios are exactly the same, but JPMorgan Chase reserves about 3.5% of its loan portfolio. Again, Citi’s reserve position seems reasonable. In particular, I am heartened to see that its credit card reserves, which will be most affected by small changes in unemployment relative to forecasts, represent 10% of loan balances on North American branded cards.

(Source: Citigroup)

On the conference call, management noted that between 40% and 60% of consumers who entered into a forbearance agreement on their Citi loan still continued to make payments. This suggests that the wave of defaults that one would normally associate with double-digit unemployment is not happening, largely because fiscal stimulus, such as improved unemployment benefits, has protected the incomes of job losses. Excluding renegotiated balances, delinquency rates on Citi’s consumer credit portfolio are just 0.9%, well below reserve levels.

All of which leads me to believe that Citi has sufficiently and prudently booked against reasonable loss expectations. Yes, there is some art to mapping future unemployment losses, and the outlook is uncertain, so we may or may not see small reserves building up from here. But, barring a second severe downturn in economic activity, we are unlikely to see reserves hitting more than $4 billion in the past two quarters. The brake on the book value of the reservation is largely behind us, which means that we can consider this book value of $71 per share as a sustainable estimate of Citi’s net asset position.

What can Citi earn on this capital?

Recognizing that the headwind of higher reserves is in the rear view mirror, we are then left to wonder what Citi’s earning power is. Most equity investors are looking for an 8-10% return on their investment over time, at least based on long-term stock market returns. For an investor to be willing to pay book value for Citi stock, they must believe that Citi can then earn a return on equity of 8 to 10 percent, or about $6.50 per share (about 1.60 to 1 $.65 per term).

With 2.08 billion shares outstanding, Citi’s COVID-19 reserve cost the company $1.78 per share (using a marginal tax rate of 21%), meaning EPS would have been $2.28 for the quarter, which seems comfortably above the needed run rate of $1.60 to $1.65 to justify a stock price of $71. However, just as the company had extraordinary reserves, it had extraordinary trading revenues due to market volatility. Fixed income trading revenue increased 68% to $5.6 billion, an incredible result. As a result, investment banking product revenues jumped 24%, while expenses only increased 7%.

This level of trading volatility is not normal, and as a result, Citi’s market making profitability will normalize. Indeed, abnormally strong trading added about $1.55 billion in net profit or $0.75/share. Investors should subtract this amount from earnings estimates at the run rate, viewing it as a one-time financial windfall. This brings “normal” EPS down to $1.53, a bit below my hurdle rate.

Certainly, there were other headwinds during this quarter. For example, the lockdowns caused a significant drop in credit card purchases, which weighed on high-margin swipe fees, and business there is becoming more normal, which may provide a little tailwind. The company also holds more than $900 billion in liquid assets, which it can move to higher-yielding assets as prospects become more secure for increasing interest income. That leaves us with normalized earnings capacity in the $1.53 to $1.60 area, or $6.10 to $6.40 for the year, just below the $6.50 I think it would take to achieve book value.

Takeaway meals

Investors need to be reassured that Citi has remained profitable during this extremely volatile time, and they can also be confident that the company has likely suffered enough loan losses that will preserve book value. However, when normalizing for a host of special factors this quarter, I get a normalized earnings profile of $6.10 to $6.40 per share, which is probably not enough to entice investors to rush to offer shares up to book value, especially given the discount that Citi tends to trade at. Still, I can see stocks rising to around 0.9 times book value or $65, barring an increase in unemployment which could lead to further loan losses. While not a 40% upside in book value, Citi offers around 30% upside from current levels, making it an attractive value investment.