As a high value investor, I can finally relate to the stories of value investing in the late 90s. Short-squeezes on message boards, daily trades, and independent valuation investing are commonplace. . While style drift is tempting, and we should always strive to expand our skill set as investors, I firmly believe that investing is an activity where one should expect profits in depending on the strength of the underlying security’s fundamental analysis. If we can’t assess it, we could still potentially speculate, but I wouldn’t call it investing. Citigroup (C) regular stock is a classic game of deep value, where the long term decline is minimal and the rise is substantial.

After the financial crisis, banking regulations have changed so much that market participants have been slow to grasp their seriousness. Most banks are positioned to be profitable, even during fairly severe recessions, while maintaining more than adequate capital ratios. CCAR and FASB stress tests provided the theoretical proof, while real-world stress in sectors such as energy, spike in unemployment and illiquid markets as we saw in March 2020, have provided real world proof. The time to buy from banks is when rates are low, credit is likely to improve, and valuations are low. Such an opportunity exists now, and Citigroup fits the bill.

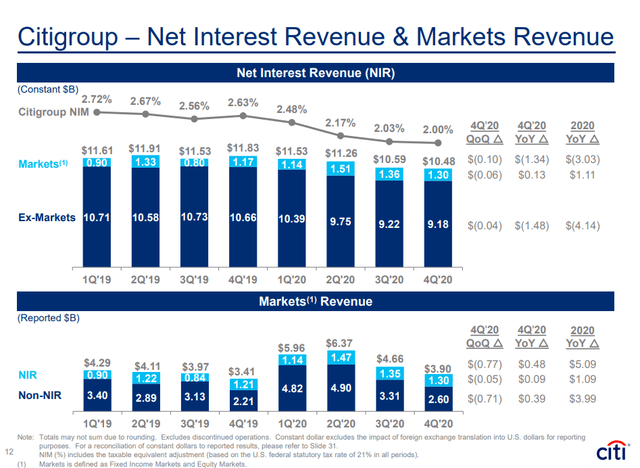

Citigroup reported strong fourth quarter earnings, supported by its ICG business. Revenue was down 10% year-on-year, mainly due to lower interest rates, while operating expenses were up 2%. That pushed the efficiency ratio up to 64.9%, from 56.9% a year ago. Net credit losses declined 24% to $ 1.472 billion. Better-than-expected credit trends allowed Citi to free up nearly $ 1.5 billion in reserves, so credit costs were negative $ 46 million, up from $ 2.222 billion in Q4 2019 Pre-tax profit of $ 5.831 billion increased 2% year-on-year. Net income of $ 4.632 billion and EPS of $ 2.08 fell 7% and 3% respectively. Citigroup generated an ROA of 0.8% and an ROTCE of 11.4% in the 4th quarter.

For the full year, Citigroup generated $ 74.298 billion in revenue, stable year-over-year. Credit costs amounted to $ 17.495 billion, including building reserves of nearly $ 10 billion. Net profit amounted to $ 11.37 billion, down 41% year-on-year. EPS of $ 4.87 was down 39%. The ROA was 0.51% and the ROTCE was 6.9%. None of these numbers are great, but when viewed against the backdrop of Covid-19 and the stress caused by lockdowns, they are certainly a testament to Citigroup’s overwhelming resilience. Deposits rose 19% to $ 1,281 billion, pushing up assets by 15%, but weak demand for loans pushed end-of-period loans down 4%. Citigroup, like the other big banks, is full of deposits, which should eventually be able to be deployed in loans and securities to increase net interest income.

Almost all of Citigroup’s profits in 2020 were generated by its ICG business. Bond and equity issuance has been massive, while trading has been buoyant throughout. Q1 2021 is off to a good start on these fronts as well, so hopefully for Citigroup the momentum can continue. Over the year as a whole, the ICG activity generated a return of 13.8% on average allocated capital. Revenue increased 13% year-on-year. Markets activity offset weakness in Treasury & Trade Solutions, which suffered from lower rates and lower commercial card revenues.

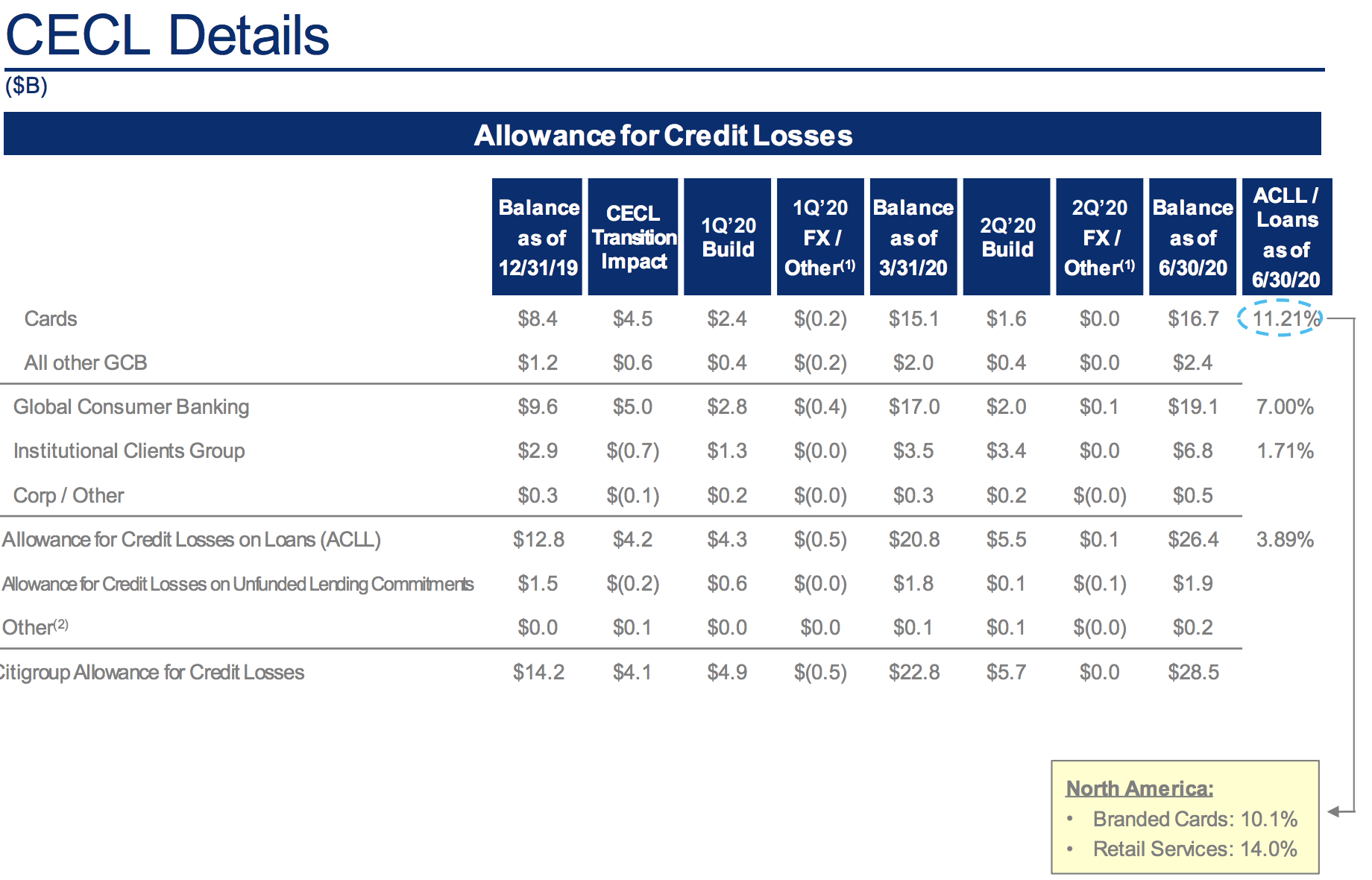

The Global Consumer Bank (GCB) has been the main source of problems for Citigroup. Revenue was down 8% year-on-year, while operating costs were down only 1%. The big problem is that the cost of credit exploded 51% to $ 11.7 billion. For the full year, net profit of $ 878 million was down 84% year-on-year. While there are still headwinds related to low interest rates, the GCB is expected to perform significantly better in 2021, simply due to falling costs of credit. If the economy performs as many hope, the demand for loans and card spending could increase significantly, which would be very important on the positive side.

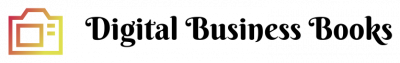

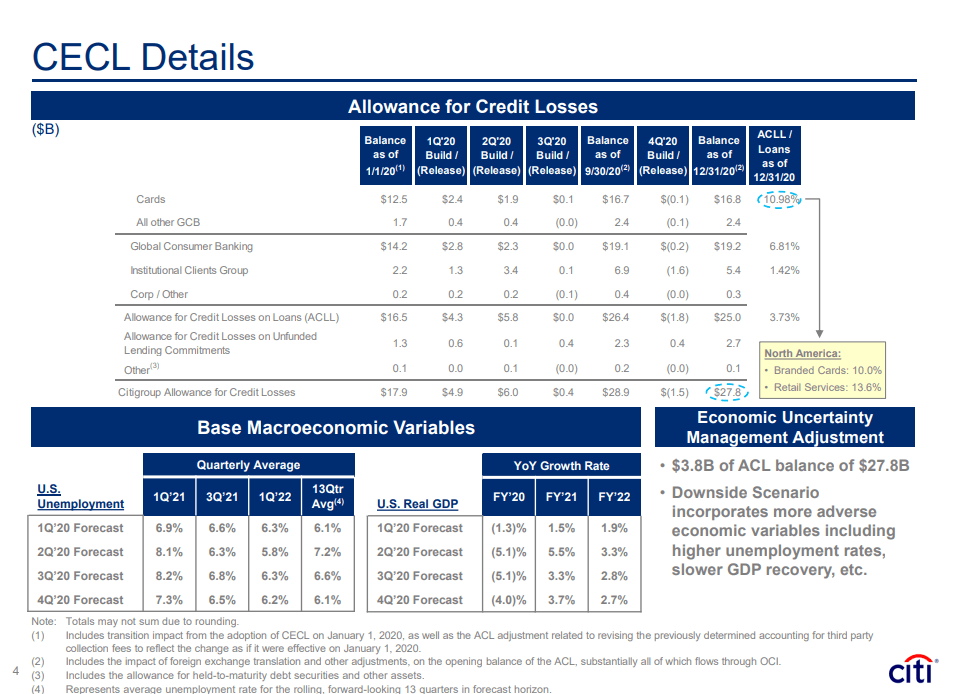

Source: C Q4 2020 investor presentation

Citigroup ended 2020 with an allowance for credit losses of $ 27.8 billion. The credit card reserve, where most losses would be expected in a recession, stood at a solid 10.98% of credit card loans. The ACLL for all loans was 3.7% and the new CECL accounting rules require banks to reserve for the term of the loans, using fairly conservative modeling. This recession has been unique in that credit has held up much better than expected, supported by the stimulus measures and the fact that many are not spending as much on activities such as travel, which allows them to accumulate money. There is a very good likelihood that Citigroup will be able to continue releasing loan loss reserves, which will then go directly to profit as the year progresses, barring a major setback in the year. ‘economy. Further relaunch looks likely, as we see a continuation of momentum towards the reopening.

I believe the biggest wildcard in economics, and in the stock market, is the path of inflation and interest rates. It is extremely difficult to imagine that inflation does not continue to rise and I think there are many signs that this is already happening in housing, stocks and commodities. If we see this, interest rates will rise faster than after the Great Recession, which would greatly benefit Citigroup’s net interest margins, which likely bottomed out in 2020. I would expect that. Net interest income improves quarterly for Citigroup in 2021, with momentum strengthening in the years to come as well. Banks can turn into high growth stocks, as they did a few years ago when rates really started to rise thanks to faster economic growth.

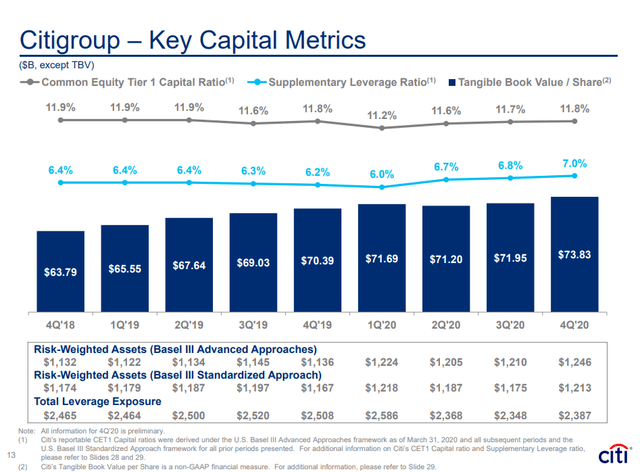

Citigroup is doing well from a capital perspective, with a CET1 ratio of 11.8%. Ultimately, this will allow the company to return most of its net profit to its shareholders, while the Fed relaxes the rules after this crisis. At a recent price of $ 60, Citigroup is selling for 81.26% of its tangible book value of $ 73.83 per share, and just over 12 times its 2020 low. Citigroup’s earnings power is between 8 and $ 9 per share, without heroic assumptions about higher interest rates. The share returns around 3.3% and begins a share buyback program in the 1st quarter. Due to the discount to the intrinsic and tangible book values at which the stock trades, these buybacks are extremely profitable for shareholders. These profitable buybacks will result in a rapid increase in book value and earnings per share. Citigroup already has billions of excess capital, so returns on capital will grow at a rapid rate pending Federal Reserve guidance.

We believe Citigroup is conservatively valued at around $ 80 per share. That puts it at around 10 times the low of its normalized earnings power, and a slight premium over tangible book value, which is set to grow as we’ve seen. There is a large margin of safety at a price of $ 60, and this is the type of value that is increasingly difficult to find in this overvalued, bubble-like market environment. Citigroup may be a growth stock in a rising interest rate environment, and it’s fair to say that interest rates are unlikely to go much lower than they are now. Equally important, the company survived an apocalyptic black swan of a pandemic and a new global lockdown strategy, while still earning nearly $ 5 a share. At some point, the market will realize that banks are the new utilities in terms of financial performance, which may seem negative at first glance, but look at the utility’s command of the multiple. Citigroup is the cheapest of the big banks from a valuation standpoint, and I think it’s the best relative value in a fertile industry as well.